CFD Trading Strategies In An Increasingly Volatile Market

As the markets become more volatile, traders must be prepared to adjust their strategies and tactics. CFD trading offers a variety of ways to take advantage of price movement in any market condition. This article will discuss some of the different CFD trading strategies that have proven effective in an increasingly volatile environment.

Table of Contents

Day Trading

Day trading is one of the most popular CFD strategies because it allows traders to capitalise on short-term price movements within a single day. By opening and closing positions quickly, traders can take advantage of small intraday trends without exposure to overnight risk or significant gaps caused by news announcements or other events outside their control. This strategy requires discipline and strong risk management skills in order to maximise profits and minimise losses.

Swing Trading

Swing trading is a style of CFD trading that involves taking advantage of medium-term price movements over several days or weeks. This strategy requires traders to take long and short positions over a few days to capture more significant profits without exposure to overnight risk. Traders on CFD trading platforms should have a strong understanding of technical analysis and charting to pick the best points for entering and exiting trades.

Trend Following

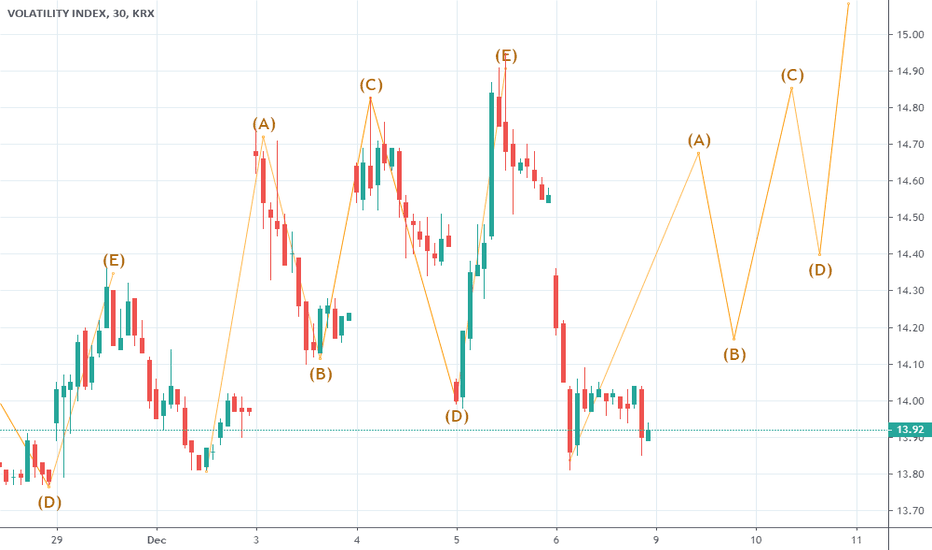

Trend-following strategies involve taking advantage of longer-term market trends that last several weeks or months. By using technical indicators such as moving averages, traders can identify trend reversals early on and capitalise on them by entering trades in the direction of the trend. This type of CFD trading is best suited for those with a strong understanding of technical analysis and chart reading skills.

Leveraged Long/Short

Leveraged long/short strategies involve taking both long (buy) and short (sell) positions in different markets while taking advantage of leverage provided by brokers. This strategy allows traders to profit from rising and falling markets, but it comes with higher risk due to the increased leverage. Before attempting this CFD trading strategy, traders should have a clear risk management plan.

Range Trading

Range trading involves taking advantage of price movements within a defined range over a specific period, such as two weeks. By using technical indicators, traders can identify periods of consolidation and take advantage of breakouts in either direction. This CFD trading strategy is best suited for those with solid chart reading skills and a good understanding of technical analysis.

Scalping

Scalping is a popular CFD trading strategy that involves taking advantage of small price movements over brief periods. This strategy requires traders to open and close positions within seconds or minutes, making it best suited for those with good execution skills and a strong understanding of technical analysis.

Momentum Trading

Momentum trading is a CFD strategy that takes advantage of price movements caused by large orders or news events. Traders will enter into trades in the momentum direction and use stop losses to limit their downside risk. This strategy requires traders to be responsive and act quickly as soon as they identify a potentially profitable opportunity.

Contrarian Trading

Contrarian trading is a strategy that involves taking the opposite side of the trade when the majority of traders are doing one thing. This type of CFD trading is best suited for experienced traders with a good understanding of market sentiment and technical analysis.

Arbitrage Trading

Arbitrage trading is a type of CFD trading where traders take advantage of price discrepancies between different markets. This strategy requires traders to act quickly to capitalise on potential profit opportunities before the price discrepancy is eliminated. Traders should have a good understanding of technical analysis and be able to identify arbitrage opportunities quickly.

Mean Reversion

Mean reversion is a trading strategy that involves taking advantage of price movements that move toward their historical averages. Traders use technical indicators such as moving averages or Bollinger Bands to identify potential areas where prices may revert to the mean. This strategy requires traders to have a strong understanding of market dynamics and chart reading skills.

Swing Trading

Swing trading is a type of CFD trading that involves taking advantage of short-term price movements. Traders look for support and resistance levels to identify potential entry and exit points. This strategy requires traders to have good chart-reading skills and a firm understanding of technical analysis.

With That Said

CFD trading can be lucrative and rewarding for those who take the time to understand and master the various strategies. However, as with any trading strategy, it is essential to have an appropriate risk management plan before attempting any of these strategies. With careful planning and an understanding of market dynamics, traders can potentially profit from CFD trading in even the most volatile markets.