Table of Contents

Introduction

In the quest for financial stability and control, managing your finances effectively is paramount. Quicken software emerges as a powerful ally in this journey, offering a comprehensive suite of tools for budgeting, expense tracking, investment management, and more. This guide delves into the features, functionalities, and best practices of mastering your finances with Quicken.

Features and Functionalities of Quicken

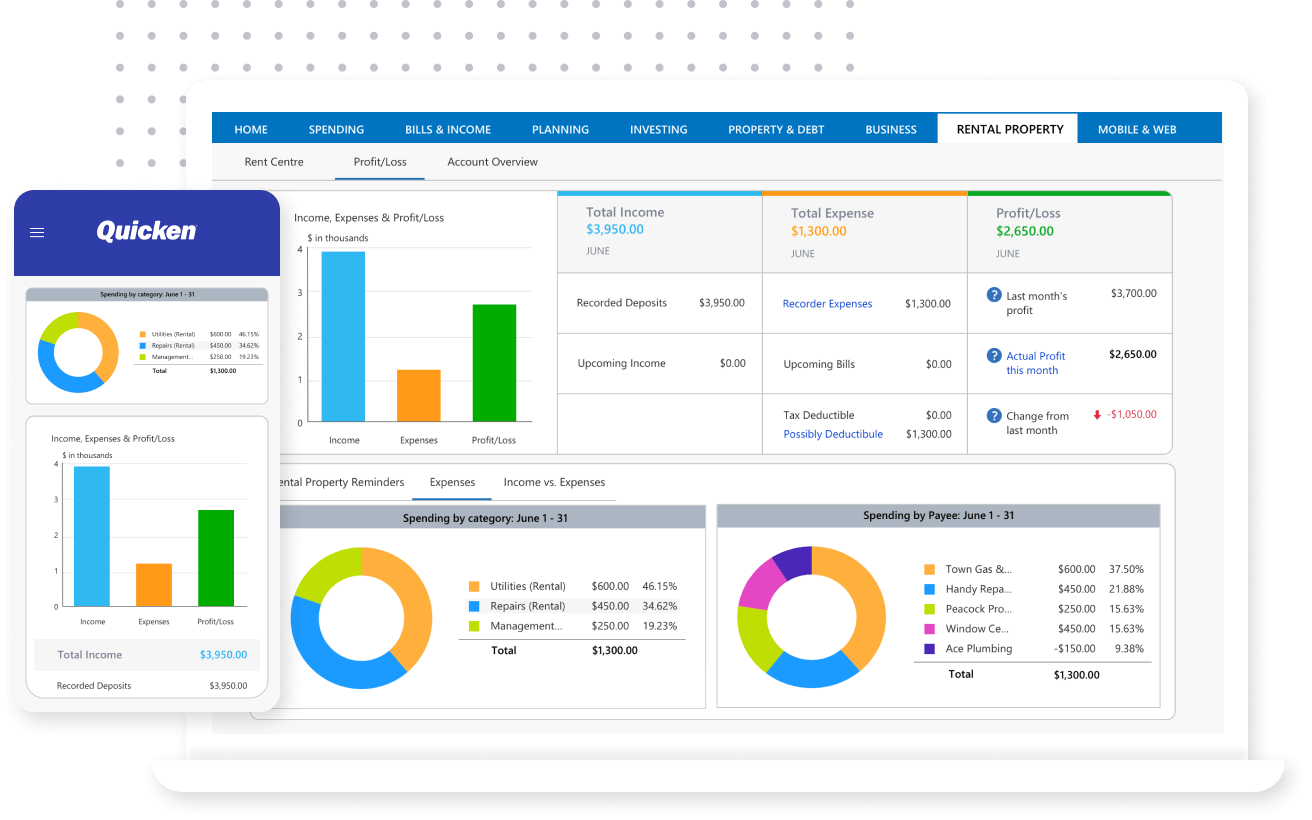

Explore the robust features of Quicken that make it a versatile financial management tool. From budgeting and expense tracking to investment management and retirement planning, Quicken covers all aspects of personal finance.

User-Friendly Interface

Navigate software chiefs.com/ user-friendly interface with ease. Learn how to customize dashboards and reports to gain personalized financial insights, empowering you to make informed decisions about your money.

Account Integration and Connectivity

Link your bank accounts, credit cards, and investment accounts seamlessly with Quicken. Experience real-time updates and streamline your financial data for a consolidated view of your financial health.

Budgeting and Expense Tracking

Take control of your spending by creating and managing budgets. Quicken’s robust tools help you track expenses, identify spending patterns, and stay on top of your financial goals.

Investment Management and Retirement Planning

Monitor your investment portfolios and plan for a secure retirement with Quicken’s dedicated tools and calculators. Gain insights into your financial future and make informed decisions about your investments.

Bill Payment and Income Tracking

Simplify bill payments and track income sources efficiently. Quicken streamlines your financial transactions, providing a comprehensive overview of your cash flow.

Financial Reporting and Analysis

Generate insightful financial reports with Quicken’s reporting tools. Analyze trends, identify areas for improvement, and make strategic decisions based on a comprehensive analysis of your financial data.

Security Measures in Quicken

Ensure the security of your financial data with Quicken’s robust security measures. Implement best practices to safeguard sensitive information and enjoy peace of mind in your financial management.

Mobile Accessibility and Syncing

Manage your finances on the go with Quicken’s mobile apps. Experience seamless syncing across devices, allowing you to stay connected and updated wherever you are.

Customization Options for Personalized Finance Management

Tailor Quicken to align with your individual financial goals. Explore customization options and utilize features that cater to your specific financial needs and preferences.

Quicken Community and Support

Engage with the Quicken user community for insights and support. Access resources to troubleshoot issues, get tips, and enhance your overall experience with Quicken.

Regular Updates and Feature Enhancements

Stay ahead of the curve by staying updated with Quicken’s latest features. Explore new functionalities and improvements to ensure you’re making the most of this dynamic financial management tool.

Success Stories and Testimonials

Draw inspiration from real-life success stories with Quicken. Witness the positive impact it has had on individuals’ personal finance management journeys.

Conclusion

In conclusion, Quicken software stands as a valuable companion on your journey to mastering your finances. From budgeting to investment management, Quicken provides the tools you need to take control of your financial destiny.