Ideas for Reducing FTMO Fees and Deposit

FTMO is a popular proprietary trading firm that provides aspiring traders with the opportunity to trade the firm’s capital. While the benefits of joining FTMO are numerous, some traders may find the fees and minimum deposit requirements challenging. In this blog, we will explore ten practical ideas for reducing FTMO fees and minimum deposit, based on the insights of analysts at Traders Union and according to an informative article.

Table of Contents

Benefits to reduce FTMO Fees

Reducing FTMO fees can have several advantages for traders looking to maximize their profits and optimize their trading performance. Here are some key reasons why it’s beneficial to reduce FTMO fees:

Cost Efficiency:

By reducing FTMO fees, traders can effectively lower their trading costs. This means a higher portion of their profits will remain in their pockets, allowing for increased profitability over time.

Improved Risk Management:

Lower fees translate to smaller overheads, enabling traders to better manage their risk. With reduced costs, traders can allocate more capital towards trades, potentially increasing their position sizes and diversifying their portfolios.

Enhanced Profitability:

When fees are minimized, traders can achieve higher net returns. This can lead to increased profitability, as even small fee reductions can accumulate over multiple trades, boosting overall gains.

Competitive Advantage:

In the highly competitive forex trading industry, reducing fees can give traders a competitive edge. Lower costs mean traders can offer more attractive spreads, potentially attracting more clients and boosting their trading volumes.

Increased Trading Opportunities:

By saving on fees, traders may have more capital available to take advantage of various trading opportunities. This flexibility allows for greater participation in the market and the ability to capitalize on favorable market conditions.

List of ideas Reducing FTMO Fees

Choose a Smaller Account Size:

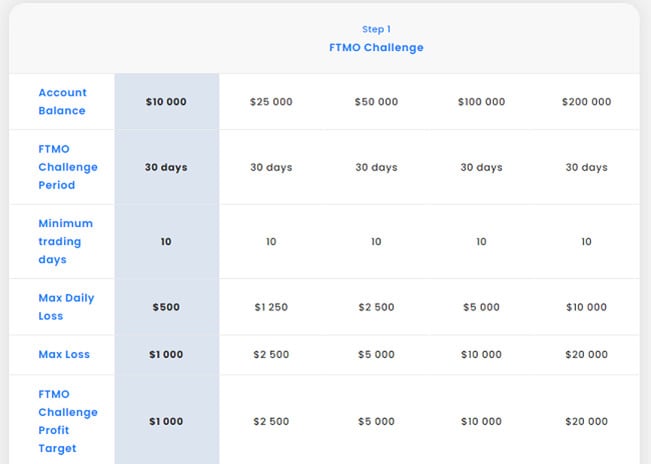

Consider starting with a smaller account size offered by FTMO. While the profit potential may be lower, it will also reduce the minimum deposit and associated fees.

Research Fee Structure:

Thoroughly understand the fee structure and associated costs. Different account types may have varying fee structures, so choose the one that aligns with your trading style and goals.

Opt for Longer Evaluation Periods:

FTMO offers different evaluation periods for traders to prove their skills. Opting for longer evaluation periods can help reduce the frequency of fee payments, giving you more time to showcase consistent performance.

Trade During Active Market Hours:

By focusing your trading activities during active market hours, you can increase the chances of capturing profitable opportunities. This can lead to faster account growth, potentially reducing the evaluation period and associated fees.

Improve Trading Performance:

Enhance your trading skills and performance by focusing on continuous learning and improvement. By becoming a consistently profitable trader, you can expedite your progression through the evaluation process, reducing the overall fees.

Utilize Risk Management Strategies:

Implementing effective risk management strategies can help protect your capital and minimize losses. This not only improves your trading performance but also reduces the likelihood of incurring additional fees due to drawdowns.

Leverage Trading Communities:

Join trading communities and engage with fellow traders to share experiences and gain valuable insights. By learning from others’ experiences, you can avoid common pitfalls and improve your trading strategies, potentially reducing fees.

Seek Educational Resources:

FTMO provides educational resources to help traders enhance their skills. Utilize these resources to further develop your trading acumen and increase the likelihood of passing the evaluation, thereby reducing fees.

Optimize Trade Execution:

Fine-tune your trade execution process to minimize slippage and ensure timely order placement. This can lead to more favorable trade outcomes, reducing potential losses and associated fees.

Consider Trading Challenges:

FTMO occasionally offers trading challenges or promotions that can provide opportunities to reduce fees or even waive them entirely. Stay updated on FTMO’s website or through trading forums to take advantage of such offers.

Conclusion:

Joining FTMO can be an exciting opportunity for traders to access proprietary trading capital. However, the fees and minimum deposit requirements may pose challenges for some traders. By implementing the ten ideas discussed above, based on insights from analysts at Traders Union and according to article, traders can potentially reduce FTMO fees and minimum deposit. Remember, it is important to thoroughly research and understand the terms and conditions associated with FTMO’s evaluation process before embarking on this opportunity. With dedication, skill development, and prudent trading practices, you can optimize your chances of success while minimizing associated costs.